Formidable Tips About How To Appeal Taxes

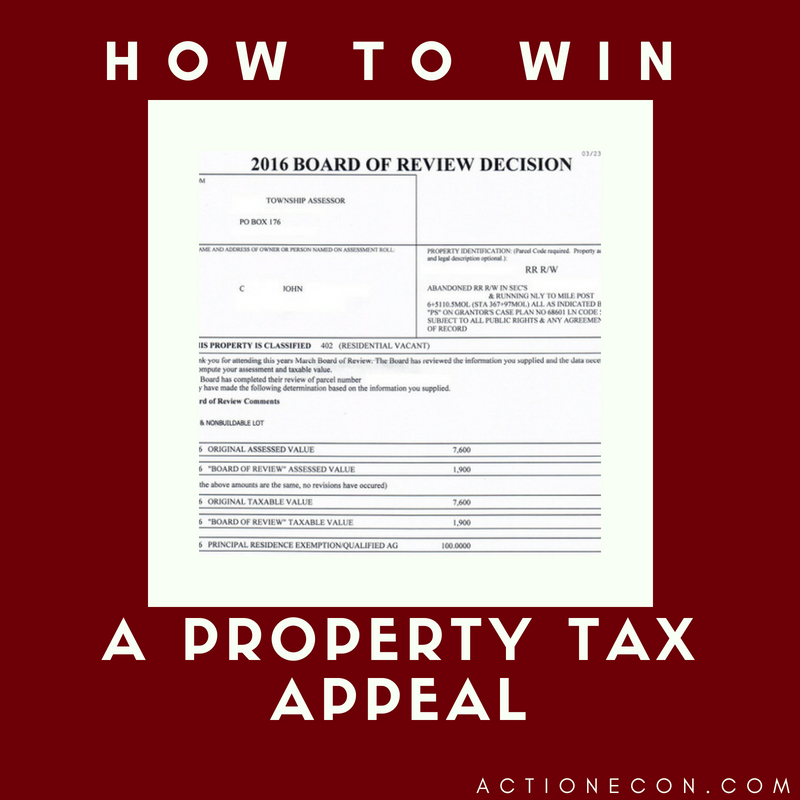

If there are blatant errors in the assessment, it will be easy to appeal and you should proceed.

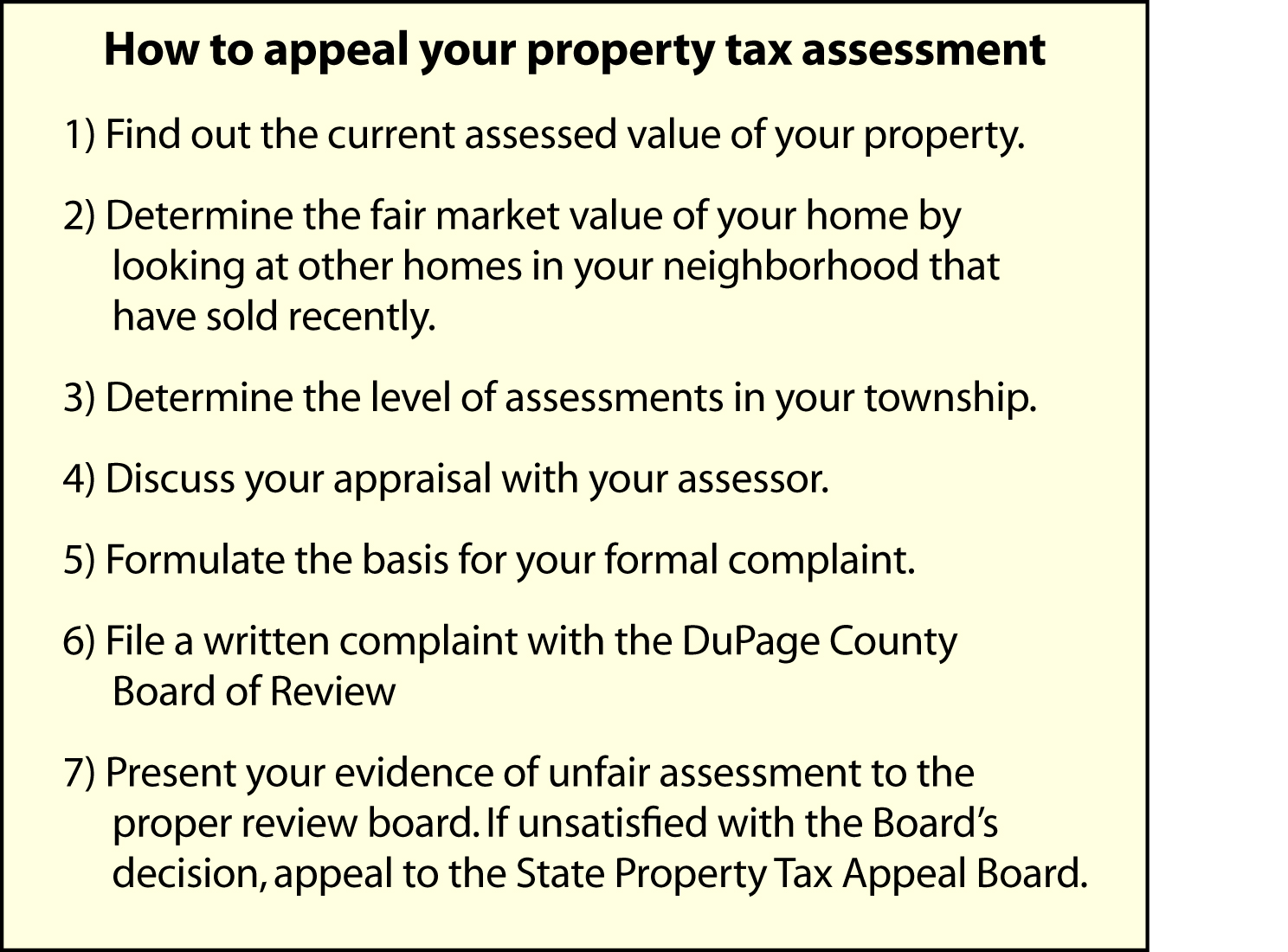

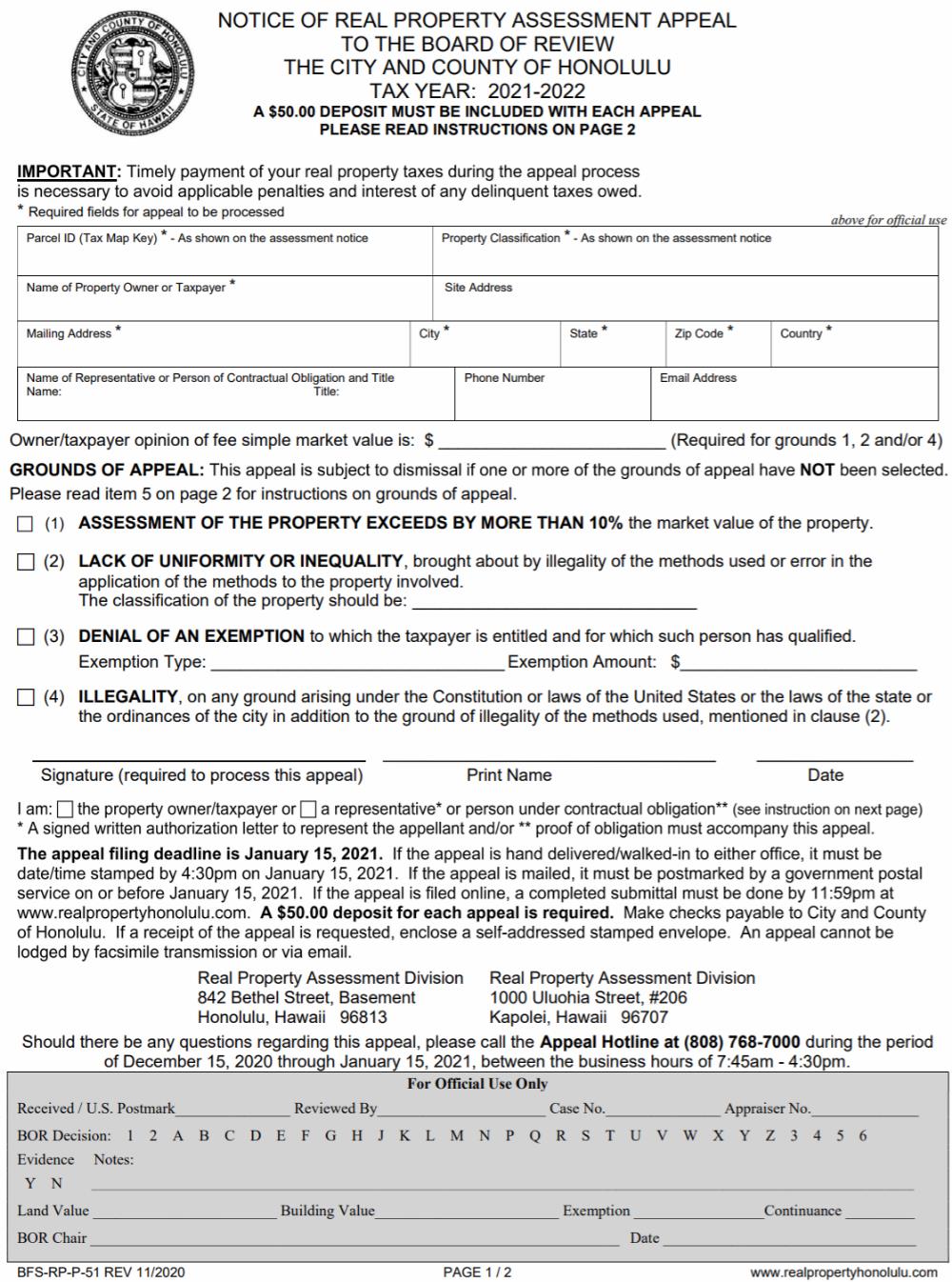

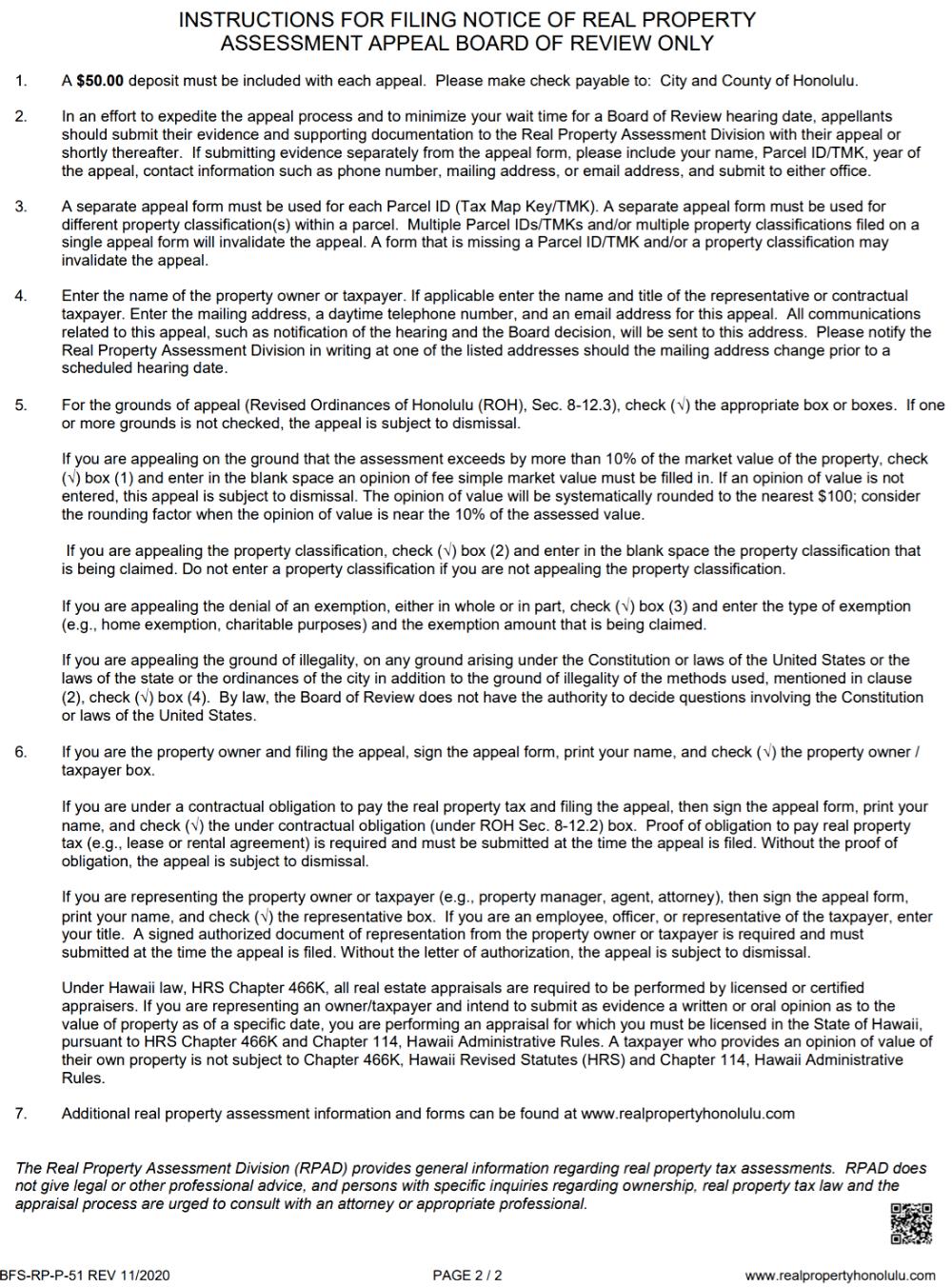

How to appeal taxes. To file online visit eappeals to learn about how property is assessed and file a real property. Please consult legal or tax professionals for. Property tax appeal procedures vary from jurisdiction to jurisdiction.

While the rules for appealing your property tax assessment vary by jurisdiction, there are many commonalities no matter where. Local governments periodically assess all the real estate they tax. During the year of the reappraisal or any year of the reappraisal cycle, a taxpayer may appeal the appraised value of his property.

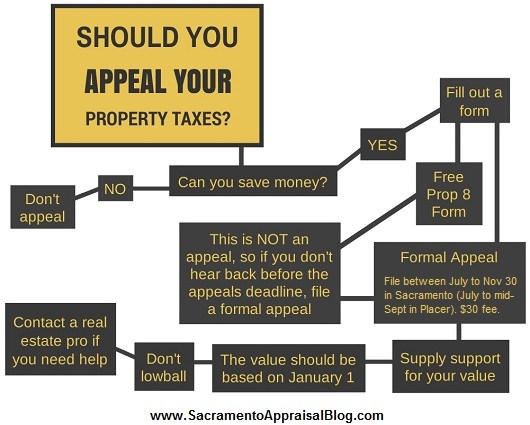

Consider changes in property values. If you wish to request a refund or appeal an assessment or determination, a petition must be filed with the board of appeals. Decide if a property tax.

Maybe “game” is the wrong word. You will then need to fill in the relevant form and send it to the. But the property tax system is somewhat labyrinthine and you.

Check your property tax assessor’s website. How to appeal your property tax assessment 1. There are two options to file an appeal with the boe:

Check to see if your township is open for appeals. You received a letter from the irs explaining your right to appeal the irs’s decision. Online videos and podcasts of the appeals process.